Still, the benefits for such expenses have not been consumed in the. For example, you may have to include the cost of interest in the cost of a constructed asset, such as a building, and then charge the cost of the building to expense over the useful life of the entire asset in the form of depreciation. Deferred expense is the expense the company has already paid for in one accounting year. You should defer expenses when generally accepted accounting principles or international financial reporting standards require that they be included in the cost of a long-term asset and then charged to expense over a long period of time. A good example of items that are not necessarily consumed at once, but which are charged to expense immediately, are office supplies. Deferred expense or prepayment, prepaid expense, plural often prepaids, is an asset representing cash paid out to a counterpart for goods or services to be. This approach reserves only larger transactions for deferral treatment.

Instead, charge these items to expense immediately, as long as there is no material effect on the financial statements.

Deferred expense software#

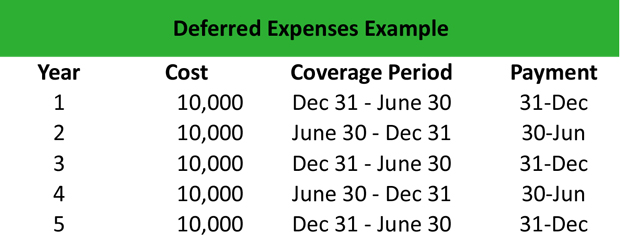

A deferred expense is initially recorded as an asset, so that it appears on the balance sheet (usually as a current asset, since it will probably be consumed within one year).įrom a practical perspective, it makes little sense to defer the expenses associated with smaller amounts of unconsumed goods and services, since the accountant must manually enter the deferral in the accounting software (rather than to the predetermined expense account), as well as remember to charge these items to expense at a later date. You would recognize the payment as a current asset and then debit the account as an expense during each accounting period. For example, you pay property insurance for the upcoming year before the policy is in effect. translation of deferred expense from English into Spanish by PROMT, transcription, pronunciation, translation examples, grammar, online translator and. The cost is recorded as an asset until such time as the underlying goods or services are consumed at that point, the cost is charged to expense. A deferred expense is paid in advance before you utilize the services. A deferred expense is a cost that has already been incurred, but which has not yet been consumed. Deferred expenses represent money paid in advance of receiving a good or service or before the related revenue is earned.

0 kommentar(er)

0 kommentar(er)